Gross versus Net Income

- Pamela Ferguson

- Aug 28, 2023

- 5 min read

When you get old enough to receive your own paycheck, you are introduced to the concept of gross versus net pay and also the world of taxation.

Gross Pay

Gross pay is the full amount you make. This would include your base wage, bonuses, and overtime. If you are paid a salary and making $50,000, let’s calculate your gross per pay period.

$50,000 / 12 = $4,166.67/month

$50,000 / 24 = $2,083.33/ bi-monthly (paid twice/month)

$50,000 / 26 = $1,923.08/ bi-weekly (paid every 2 weeks)

$50,000 / 52 = $961.54 / week

$50,000 / 2080 (hours per year) = $24.04/hour

Net Pay

The net pay is the gross pay minus deductions and taxes. The total amount that is deducted from your paycheck will vary by individual, but it generally ranges from 15%-25%. Common payroll deductions include:

· Health Insurance Premiums

· 401K Contributions

· HSA (Health Savings Account)

· Short and Long Term Disability

· Federal and State Taxes

· Payroll (FICA-Federal Insurance Contribution Act) Taxes

· Wage Attachments (Garnished Wages/Tax Liens, etc.)

· Any W4 Elections per Employee upon Hire)

Health Insurance Premiums:

Any costs for insurance plans through your employer.

401K Contributions:

Deductions for the company sponsored 401K retirement plan. Organizations decide how and if they want to offer 401K retirement plans to their employees. Some companies offer the ability to contribute immediately, some after 3 months and even up to a year before you can start to earn the 401K benefit.

Companie may only offer the option for the employee to contribute and others may match an amount that you put it.

There are a large variety of matches depending on the company. That means your company will match the amount of money that you personally put toward your 401K retirement plan. Employers may match dollar for dollar up to a certain percentage and others will match up to the maximum contribution. However, the most common match is 50% up to 6%. That means, if your annual salary is $50,000, and you contribute $3,000, your employer will put in $1,500 in the account FOR FREE. That’s free money. I would recommend contributing the max amount that the company matches or else you’re leaving money on the table. In our example, this would be $3,000 for the year split out over every pay period. If you are paid every 2 weeks, this would be $115.38 that would be deducted. What’s even better about the scenario is the money is taken out pre-tax and that means that you’re not taxed on it.

HSA (Health Savings Account):

A health savings account is a personal savings account that can be used for medical. You can use it for items such as deductibles, copayments, prescriptions, and some over the counter items. This program is helpful for those that have high deductible plans to cover out of pocket expenses. Any contributions to the plan are exempt from federal income tax and any earnings grow tax free. Unspent money within a calendar year will roll over to the next year. This is different than FSA’s (Flexible Spending Accounts). If you withdraw funds from the account for non-qualified expenses before the age of 65, you will be hit with a 20% penalty in addition to paying income taxes on the amount. Your goal should be to use as close to all your funds by the end of the year. This can be difficult as no one typically knows their medical expenses in advance.

Short- and Long-Term Disability:

Per www.musedisability.com, “Every employed person is required to give a percentage of his or her income to the Disability Insurance Trust Fund to fund Social Security Disability Insurance. Currently, the percentage stands at 6.2% per employee. The employer is also required to kick in 6.2% of a worker’s income. This contribution is added to the Disability Insurance Trust Fund, a separate fund in the U.S. Treasury intended to help people who became disabled and cannot earn an appropriate wage. The trust fund provides automatic spending authority to pay monthly benefits to disabled-worker beneficiaries and their spouses and children. While some workers may complain about how much of their gross pay is sent directly to the federal government, the portion dedicated to Social Security Disability provides a protection of income for them and their families – a protection they may find very necessary one day.”

Federal and State Taxes:

All workers must pay federal taxes. You are taxed in coordination with your tax bracket. There are currently seven tax brackets which range from 10-37% based on your income. In addition, you may have to pay a state income tax and the amount varies by state. As of 2022, there are 9 states that don’t have state income taxes. Alaska, Florida, Nevada, New Hampshire, North Dakota, Tennessee, Texas, Washington, and *Wyoming. Washington does levy a state capital gains tax on certain high earners.

Payroll (FICA-Federal Insurance Contribution Act) Taxes:

FICA Taxes are a combination of Social Security (6.2%) and Medicare (1.45%). Those with higher taxable incomes may have to pay up to 8.55% in total.

Wage Attachments:

Wage attachments are any unpaid items resulting from a court order or authorized agency. Some common examples include child support, unpaid taxes, student loans, etc.

W4 Elections:

This is determined by your elections upon hire. It is determined by how many jobs you have as well as how many dependents. A single person who has one job has fewer allowances than a married person with children.

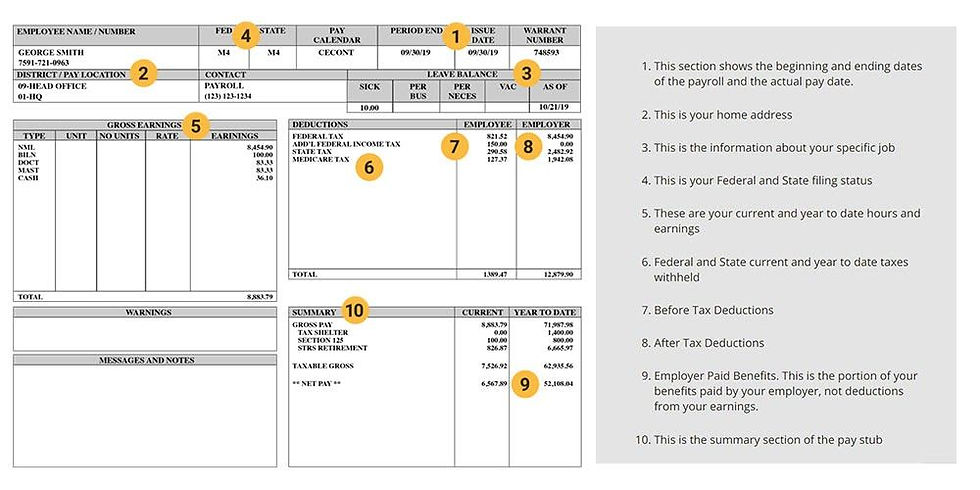

Example of paystub:

This section shows the beginning and ending dates of the payroll and the actual pay date.

This is your home address

This is the information about your specific job

This is your Federal and State filing status

These are your current and year to date hours and earnings

Federal and State current and year to date taxes withheld

Before Tax Deductions

After Tax Deductions

Employer Paid Benefits. This is the portion of your benefits paid by your employer, not deductions from your earnings.

This is the summary section of the paystub

If you haven’t taken the time yet, pull out your paystub and go through each section one at a time. In making purchases many people say, “I’d have to work 6 hours to pay for these pair of shoes for sale for $90.” That’s not true. If you make $15/hour GROSS, you don’t actually take home $15/hour. It’s more likely that you pocket only $12/hour. So next time before you do this mini calculation, make sure you adjust for the amount that is taken out in taxes. Instead of 6 hours to pay for the shoes, it will take 7.5 hours. And that doesn’t even include the tax on the shows. Factoring that in, it may be longer. Looking at the calculation like this tends to open your eyes to the effect of taxes on our everyday lives. Taxes affect so many things in our life. Remember that no one lives on their gross salary, but only on their net.

Comments